Search Category: Income Tax

2022 Tax Rebates: Frequently Asked Questions

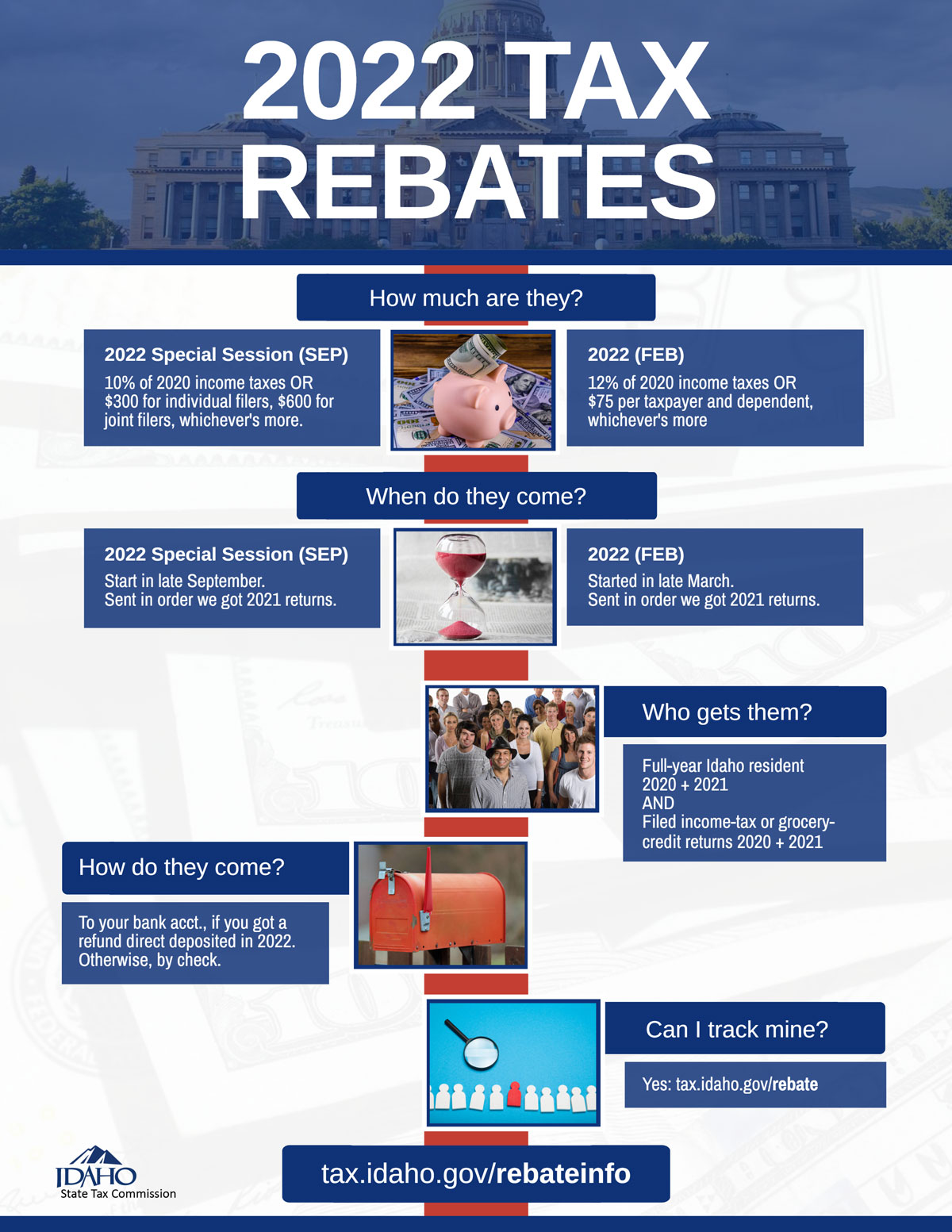

Idaho is giving eligible taxpayers two rebates in 2022:

- 2022 Special Session rebate: On September 1, 2022, a Special Session of the Idaho Legislature passed and Governor Brad Little signed House Bill 1 authorizing a tax rebate to full-year residents of Idaho.

- 2022 rebate: On February 4, 2022, Governor Little signed House Bill 436 that provided a tax rebate to full-year residents of Idaho.

FAQs

The amount of each rebate is different, but the qualifications and process to get them are the same.

What are the amounts of the tax rebates?

The amounts are based on the most recent, approved 2020 tax return information on file at the time we issue the rebates.

- Amount of the 2022 Special Session rebate, whichever is greater:

- $300 for individual filers [includes filing statuses Single, Head of Household, Qualifying Widow(er) and Married Filing Separately]; $600 for joint filers

- 10% of the tax amount reported on Form 40 (line 20), or Form 43 (line 42) for eligible service members using that form

- Amount of the 2022 rebate, whichever is greater:

- $75 per taxpayer and each dependent

- 12% of the tax amount reported on Form 40 (line 20), or Form 43 (line 42) for eligible service members using that form

- Amount of the 2022 Special Session rebate, whichever is greater:

I received an email telling me I’m going to get a rebate. Is this legitimate?

- Yes. We send emails about the rebates on behalf of Governor Little and the Legislature. The emails go to people who e-filed their 2021 income tax returns because we have their email addresses.

Who’s eligible for the tax rebates?

- Any Idahoan who was a full-year resident in 2020 and 2021 and who also filed an Idaho individual income tax return or a Form 24 for those years is eligible for the rebates. Nonresidents and part-year residents aren’t eligible.

- A full-year resident is someone domiciled in Idaho for the entire tax year. Domicile is the place you have your permanent home and where you intend to return whenever you’re away; it’s the place that’s the center of your personal and business life. If you’re stationed in Idaho on active military duty, you’re considered a resident of the state where you’re domiciled.

What do I need to do to get my tax rebates?

You need to file your 2020 and 2021 individual income tax returns by December 31, 2022, to receive the rebates.

How do I receive my rebate payments?

- Taxpayers who provided valid bank information when filing their 2021 tax returns receive the payments through a direct deposit to their bank account. All other taxpayers receive checks at the most recent address we have on file. This includes taxpayers who used a refund product (such as a refund anticipation loan) when filing their return with tax software or a tax preparer.

When will the Tax Commission start issuing the tax rebate payments?

- We start processing payments for the 2022 Special Session rebate in late September, issuing them to eligible taxpayers in the order of the date we received the 2021 tax returns. We start with taxpayers who are eligible to receive the rebate through direct deposit and then move to those who will receive a check. About 75,000 payments will go out weekly. We’ll continue to process payments throughout 2022 and early 2023 as taxpayers file their returns and become eligible for the rebate.

- We’ve already issued the majority of the first 2022 rebate payments, but we continue to send more as taxpayers file their returns and become eligible.

How can I check the status of my rebate payment?

- You can track the status of your rebates using the Where’s My Rebate tool at tax.idaho.gov/rebate

- You can use this tool anytime. The information in the tool is the same information that our Taxpayer Services representatives can provide over the phone.

- To retrieve your rebate status, you’ll need:

- Your Social Security number or Individual Taxpayer Identification Number

- Your Idaho driver’s license number, state-issued ID number, or 2021 Idaho income tax return

What if my filing status changed between 2020 and 2021?

- We calculate the rebates using the information on your 2020 tax return. If your filing status changed when you filed your 2021 tax return, the amount of the rebates you receive might be affected in certain cases. For example:

- You filed as Single in 2020 but filed as Married Filing Jointly in 2021. Your rebates are based on the 2020 return, and you receive the full amount of each rebate.

- You filed as Married Filing Jointly in 2020 but filed as Single or Head of Household in 2021. Your rebates are based on the 2020 return, but you receive only half the amount of each rebate. We split the rebates equally between you and your ex-spouse (following Idaho Community Property law 32-906).

- We calculate the rebates using the information on your 2020 tax return. If your filing status changed when you filed your 2021 tax return, the amount of the rebates you receive might be affected in certain cases. For example:

My address has changed since I filed my 2021 tax return. How do I update it so I can get my rebate check or checks?

- Email RebateAddressUpdate@tax.idaho.gov to request an update. Please provide your:

- Full Name

- Last four digits of your Social Security number or Individual Taxpayer Identification Number

- Previous address

- New address

- We’ll update your address within three to five business days. However, we won’t be able to reply to your email due to the number of requests we expect. Please only use this email address to send us a change to your mailing address. If you have rebate questions, see the other FAQs on this page or email us at Submit a question. You should receive a response within 5 to 7 business days.

- Email RebateAddressUpdate@tax.idaho.gov to request an update. Please provide your:

Can I still get the tax rebates if I wasn’t required to file a tax return?

- If you aren’t required to file a return, you might be eligible to file one for any overpaid withholding or to receive the grocery credit. You must be an Idaho resident to receive the grocery credit. Visit the Income Tax hub at tax.idaho.gov/incomehub for more information.

Why haven’t I received my rebates? I filed my 2020 and 2021 tax returns.

- All income tax returns go through fraud detection reviews and accuracy checks. We might send you letters to verify your identity or to ask for more information. If you don’t respond to these letters, we can’t finish processing your returns. As a result, your rebate payments will be delayed.

Do you apply my tax rebates to other amounts I owe?

- Yes. We’ll reduce your rebate payment if you have other tax debts with the Tax Commission (e.g., you owe income tax, sales tax, withholding tax, etc.), or if you have any outstanding obligations to the following:

- Idaho Department of Health and Welfare (usually for unpaid child support). Call (208) 334-2479 in the Boise area or toll free at (800) 356-9868.

- Idaho Department of Labor (for unreimbursed unemployment overpayments). Call (208) 332-3576 in the Boise area or toll free at (800) 448-2977.

- Idaho Supreme Court (for unpaid court-ordered fines, fees, or restitution). Call (208) 947-7445.

- County Sheriff departments (for sheriff’s garnishments). Call (208) 577-3750.

- Internal Revenue Service (for unpaid federal tax debts). Call toll free at (800) 829-7650.

- Bankruptcy trustees – You might receive a letter from us if we reduce your rebate payment.

- Yes. We’ll reduce your rebate payment if you have other tax debts with the Tax Commission (e.g., you owe income tax, sales tax, withholding tax, etc.), or if you have any outstanding obligations to the following:

Are the rebates taxable?

- Rebates are handled exactly like regular refunds; they’re not taxable to Idaho. However, they might be taxable on the federal level. Please see the instructions for your federal income tax return for reporting state and local income tax refunds.

Who can I contact for more information?

- If you have questions, please call us at (208) 334-7660 in the Boise area or toll free at (800) 972-7660.

2021 Tax Rebate

Need information about the 2021 tax rebate? Read our 2021 tax rebate FAQs.

Rulemaking – Income Tax Rule 35.01.01

We are currently doing a comprehensive revision of this chapter according to the guidelines of Executive Order 2020-01, Zero-Based Regulation. We invite the public to be involved or send us your comments.

- Current status: https://adminrules.idaho.gov/bulletin/2022/04.pdf

- Committee: Income Tax Rules Committee

- Committee Chairperson: Cynthia Adrian (208) 332-6691

- Administrative Rules Coordinator: Kimberlee Stratton (208) 334-7544

Status of Rulemaking

Idaho Administrative Bulletin:

Participate

If you want to comment on this rule:

- Attend a rules committee meeting. Dates and times are listed on our Calendar page and meeting dates and agendas are listed on the Income Tax Rules Committee page.

- Write to us at: Rules Coordinator, Idaho State Tax Commission, PO Box 36, Boise ID 83722-0410

- Email the Rules Coordinator.

Meetings

Meeting dates and locations are listed on the Income Tax Rules Committee page.

Drafts and Public Comments

- Sections (Rules) 001-299 and 700-999 Updated 07/12/2022

- Sections (Rules) 001-299 and 700-999 Updated 08/11/2022

- Sections (Rules) 300-699 updated 07/13/2022

- Sections (Rules) 300-699 updated 07/25/2022

- Sections (Rules) 300-699 Updated 09/02

- This document explains the changes from the 7/13 draft to the 7/25 draft. Changed text is highlighted in yellow on the 7/25 draft.

- This document explains the changes to the 09/02 draft revision for Docket 02. Changed text is highlighted in yellow on the 09/02 draft.

- FIST Letter 09/01/2022

- IACI Letter Docket 01 08/31/2022

- IACI Letter Docket 02 08/31/2022

- ISCPAs Letter 09/01/2022

- Rick Smith Email 07/06/2022

- Rick Smith Email 08/03/2022

- Rick Smith Email 08/04/2022

- Rick Smith Email 08/22/2022

Instruction Changes for 2021 Individual Income Tax Returns

Qualifying age raised for Idaho Child Tax Credit

Congress temporarily increased the age of a qualifying child from 16 and under to 17 and under for the federal definition of a qualifying child. Since the Idaho child tax credit uses the federal definition, Idaho Form 40, line 25 (page 9 in the instructions) and Idaho

Form 43, line 46 (page 21 in the

instructions) should now read:

- Be age 17 or under as of December 31, 2021

Federal credit for child and dependent care expenses increased

Idaho allows a deduction for expenses paid to care for a child or other dependent. Idaho uses the federal limitations on the amount of expenses. The federal limits were raised from $3,000 for one child or dependent or $6,000 for more than one child, to $8,000 for one child or $16,000 for more than one child.

On line 2 of the Child and Dependent Care Worksheet for Form 39R, Part B, line 6 (page 30 of the

instructions) and for

Form 39NR, Part B, line 4 (page 42 of the

instructions), enter $8,000 for one child or dependent or $16,000 for more than one child or dependent.

Charitable deduction for taxpayers taking the standard deduction

Taxpayers who don’t itemize deductions can take a charitable deduction for cash contributions made in 2021 to qualifying organizations.

If you claimed the standard deduction on federal Form 1040 and reported a charitable contribution on line 12b, add that amount to the amount on Idaho Form 40, line 16 for Idaho residents or Form 43, line 36 for Idaho part-year and nonresidents.

Don’t enter more than $300 if filing as single, head of household, married filing separately, or qualifying widow(er) or $600 if married filing jointly.

If you’re e-filing, your software package should add this deduction to your Idaho return automatically.

Idaho subtraction for taxpayers with qualified disaster loss

Idaho taxpayers who’ve suffered a disaster loss in Benewah, Bonner, Kootenai, and Shoshone counties because of straight-line winds on January 13, 2021, can report the loss amount on Idaho Form 39R. Go to line 23 (Other Subtractions), and provide an explanation of the subtraction. For federal purposes, taxpayers can increase their standard deduction for this loss without itemizing.

Qualified business income (QBI) deduction for part-year and nonresident taxpayers

There’s now a new way for part-year residents and nonresidents to calculate their Idaho qualified business income (QBI) deduction. The deduction is proportional to the Idaho qualifying business activity. (See Idaho Income Tax Administrative Rule 252.02 for more information.) These instructions are for Idaho Form 43, line 40 qualified business deduction.

Worksheet

- Enter the business information in the table below using information from your K-1s and federal Form 8995. Then add your totals for Column (c) and for Column (e).

(a)

Business name

(b)

Taxpayer identification number

(c)

Total qualified business income or (loss)

(d)

Idaho apportionment factor

(e)

Idaho source qualified business income or (loss) (Multiply Column c by Column d)

TOTAL: TOTAL: - Divide the total of Column (e) by the total of Column (c) for your Idaho percentage of qualified business income….. ___________

- Enter the qualified business income deduction you claimed on your federal return……………………….. ___________

- Multiply line 2 by line 3 to calculate your Idaho qualified business income deduction…………………… __________

- Enter the amount from line 4 on Idaho

Form 43, line 40.

Coronavirus and Idaho Taxes: Frequently Asked Questions and Answers

Below are answers to frequently asked questions about the coronavirus pandemic and Idaho taxes. If your question isn’t addressed below, please assume business as usual or contact the Tax Commission. This list will be updated as new information becomes available.

- Have you extended the deadlines for any taxes due in 2021?

Yes. The Tax Commission has extended the 2020 Idaho income tax filing and payment deadlines from April 15, 2021, to May 17,2021, to match the extended federal deadline.

Idaho’s extension applies to all taxpayers subject to Idaho’s individual income tax (i.e., individuals, trusts, and estates), regardless of the amount owed. Penalty and interest won’t apply if taxpayers file their return and pay the income tax they owe by May 17.

The Tax Commission also extended the deadline to apply for property tax relief programs from April 15 to May 17. The programs include:

- Property Tax Reduction (circuit breaker)

- Property Tax Deferral

- 100% Service-Connected Disabled Veterans Benefit

- Is the pandemic delaying income tax refunds?

At this time, we don’t see any delay in processing refunds. We’ve issued most refunds within the expected timeframes. While many refunds can be processed sooner — especially on e-filed returns — some can take up to 11 weeks, especially if the return is incomplete and we need to contact taxpayers for clarification.

- When will I get my stimulus payment?

The federal government is issuing stimulus payments, not the State of Idaho. The IRS has information on its website about when you’ll get your payment. Visit irs.gov/coronavirus/get-my-payment.

Audits

- I’m working with a tax auditor. What’s the best way to stay in touch?

Please contact the auditor by phone or email.

Payment Plans

- I have a payment plan with you. How do I stay in touch?Please email us at paymentplanchange@tax.idaho.gov if you have questions or need to make changes to your plan.

Resources

- coronavirus.idaho.gov — Get information on the coronavirus in Idaho.

- irs.gov/coronavirus — Get information on the coronavirus and federal taxes, including the status of your federal stimulus payment.

Form 402

Individual Apportionment for Multistate Businesses

| Form ID | Form Name | Year |

|---|---|---|

| 402 | Current Version | 2025 |

| 402 | 2022 | |

| 402 | 2021 | |

| 402 | 2020 | |

| 402 | 2019 |

FORM 40EZ, 40, 43, 39R, 39NR, TAX TABLES

Instructions - Individual Income Tax

| Form ID | Form Name | Year |

|---|---|---|

| 40, 43, 39R, 39NR | Current Version | 2025 |

| 40, 43, 39R, 39NR | 2025 | |

| 40, 43, 39R, 39NR | 2025 | |

| 40, 43, 39R, 39NR | 2024 | |

| 40, 43, 39R, 39NR | 2023 | |

| 40, 43, 39R, 39NR | 2022 | |

| 40, 43, 39R, 39NR | 2021 | |

| 40, 43, 39R, 39NR | 2020 | |

| 40, 43, 39R, 39NR | 2019 | |

| 40, 43, 39R, 39NR | 2018 | |

| 40, 43, 39R, 39NR | 2013 |

Nonprofits and Income Tax

This page provides some basic Idaho income tax information for nonprofits.

- All nonprofits in Idaho must register with the Idaho Secretary of State.

- Contact the Internal Revenue Service (IRS) to request approval for an income tax exemption. Read more on the IRS Applying for Tax Exempt Status page.

Filing requirements

See the current-year business income tax forms.

You must file Idaho Form 66 if you’re a resident IRA trust or other trust required to report unrelated income.

Exempt from tax

Organizations to which the IRS has granted exempt status also are exempt from Idaho income tax.

Exception: You must file an Idaho income tax return based on your entity type and pay Idaho tax on any unrelated business income your organization reports on federal Form 990-T.

Interest and Penalties

Interest applies to overdue tax from the original due date of the return until you pay the tax. See interest rates for recent years.

Penalties apply to late returns, late payments, or both. The law determines calculations, and they differ by tax type.

It’s important that you get in touch with us if you’ve forgotten to file for one or more tax periods.

When penalty applies

By law, you’ll owe a penalty if you:

- Don’t file a tax return on time (5%/month to a maximum of 25%).

- File a return on or before the original due date and pay tax due after you file (0.5%/month to a maximum of 25%).

- Don’t have a valid extension and don’t pay tax due by the original due date (2%/month from the original due date to the payment date).

- Substantially understate tax due (10%).

- Disregard rules without an intent to defraud (5%).

- File a false or fraudulent tax return (50%).

The minimum penalty is $10.

Calculating income tax penalty

See how we calculate penalties for income tax, based on the law: How Your Income Tax Penalty Is Calculated.

You can also use the Penalty and Interest Estimator to calculate what you could owe.

Extensions

You might qualify for an extension to file your income tax return without a filing penalty.

- Extensions don’t apply to payments — you must pay in full by the original due date to avoid interest and possible penalties.

- Even with a valid extension, you must pay any tax you owe when you file your return during the extension period, or a penalty applies.

- The other penalties described above might also apply.

What you don’t know about a “valid extension” for your income tax return can hurt you. See the Extensions page for more information.

Individual Income Tax Forms Archive

Form 24

Grocery Credit Refund and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 24 | 2024 | |

| 24 | 2023 | |

| 24 | 2022 | |

| 24 | 2021 | |

| 24 | 2020 | |

| 24 | 2019 | |

| 24 | 2018 | |

| 24 | 2017 | |

| 24 | 2016 | |

| 24 | 2015 |

Form 39NR

Part-year Resident and Nonresident Supplemental Schedule

| Form ID | Form Name | Year |

|---|---|---|

| 39NR | 2024 | |

| 39NR | 2023 | |

| 39NR | 2022 | |

| 39NR | 2021 | |

| 39NR | 2020 | |

| 39NR | 2019 | |

| 39NR | 2018 | |

| 39NR | 2017 | |

| 39NR | 2016 | |

| 39NR | 2015 |

Form 39R

Resident Supplemental Schedule

| Form ID | Form Name | Year |

|---|---|---|

| 39R | 2024 | |

| 39R | 2023 | |

| 39R | 2022 | |

| 39R | 2021 | |

| 39R | 2020 | |

| 39R | 2019 | |

| 39R | 2018 | |

| 39R | 2017 | |

| 39R | 2016 | |

| 39R | 2015 |

Form 40

Individual Income Tax Return

| Form ID | Form Name | Year |

|---|---|---|

| 40 | 2025 | |

| 40 | 2025 | |

| 40 | 2024 | |

| 40 | 2023 | |

| 40 | 2022 | |

| 40 | 2021 | |

| 40 | 2020 | |

| 40 | 2019 | |

| 40 | 2018 | |

| 40 | 2017 |

Form 40EZ

Income Tax Return for Single and Joint Filers With No Dependents

| Form ID | Form Name | Year |

|---|---|---|

| 40EZ | 2005 |

Form 40, 43, 39R, 39NR

Instructions - Individual Income Tax

| Form ID | Form Name | Year |

|---|---|---|

| 40, 43, 39R, 39NR | 2025 | |

| 40, 43, 39R, 39NR | 2025 | |

| 40, 43, 39R, 39NR | 2024 | |

| 40, 43, 39R, 39NR | 2023 | |

| 40, 43, 39R, 39NR | 2022 | |

| 40, 43, 39R, 39NR | 2021 | |

| 40, 43, 39R, 39NR | 2020 | |

| 40, 43, 39R, 39NR | 2019 | |

| 40, 43, 39R, 39NR | 2018 | |

| 40, 43, 39R, 39NR | 2013 |

Form 43

Part-Year Resident & Nonresident Income Tax Return

| Form ID | Form Name | Year |

|---|---|---|

| 43 | 2023 | |

| 43 | 2022 | |

| 43 | 2021 | |

| 43 | 2020 | |

| 43 | 2019 | |

| 43 | 2018 | |

| 43 | 2017 | |

| 43 | 2016 | |

| 43 | 2015 | |

| 43 | 2014 |

Form 49ER

Recapture of Qualified Investment Exemption from Property Tax and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 49ER | 2024 | |

| 49ER | 2023 | |

| 49ER | 2022 | |

| 49ER | 2021 | |

| 49ER | 2020 | |

| 49ER | 2019 | |

| 49ER | 2018 | |

| 49ER | 2017 | |

| 49ER | 2016 | |

| 49ER | 2015 |

Form 49R

Recapture of Idaho Investment Tax Credit and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 49R | 2024 | |

| 49R | 2023 | |

| 49R | 2022 | |

| 49R | 2021 | |

| 49R | 2020 | |

| 49R | 2016 | |

| 49R | 2015 | |

| 49R | 2014 | |

| 49R | 2013 | |

| 49R | 2019 |

Form 49

Investment Tax Credit and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 49 | 2024 | |

| 49 | 2023 | |

| 49 | 2022 | |

| 49 | 2021 | |

| 49 | 2020 | |

| 49 | 2019 | |

| 49 | 2018 | |

| 49 | 2017 | |

| 49 | 2016 | |

| 49 | 2015 |

Form 49C

Investment Tax Credit Carryover and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 49C | 2023 | |

| 49C | 2022 | |

| 49C | 2021 | |

| 49C | 2020 | |

| 49C | 2019 | |

| 49C | 2018 | |

| 49C | 2017 | |

| 49C | 2016 | |

| 49C | 2015 | |

| 49C | 2014 |

Form 51

Estimated Payment of Individual Income Tax

| Form ID | Form Name | Year |

|---|---|---|

| 51 | 2024 | |

| 51 | 2023 | |

| 51 | 2022 | |

| 51 | 2021 | |

| 51 | 2020 | |

| 51 | 2019 | |

| 51 | 2018 | |

| 51 | 2017 | |

| 51 | 2016 | |

| 51 | 2015 |

Form 56

Net Operating Loss Schedule

| Form ID | Form Name | Year |

|---|---|---|

| 56 | 2024 | |

| 56 | 2023 | |

| 56 | 2023 | |

| 56 | 2022 | |

| 56 | 2021 | |

| 56 | 2020 | |

| 56 | 2019 | |

| 56 | 2016 | |

| 56 | 2013 | |

| 56 | 2013 |

Form 67

Credit for Idaho Research Activities and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 67 | 2024 | |

| 67 | 2023 | |

| 67 | 2022 | |

| 67 | 2021 | |

| 67 | 2020 | |

| 67 | 2019 | |

| 67 | 2018 | |

| 67 | 2017 | |

| 67 | 2016 | |

| 67 | 2015 |

Form 68

Broadband Equipment Investment Credit and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 68 | 2024 | |

| 68 | 2023 | |

| 68 | 2022 | |

| 68 | 2021 | |

| 68 | 2020 | |

| 68 | 2019 | |

| 68 | 2018 | |

| 68 | 2017 | |

| 68 | 2016 | |

| 68 | 2015 |

Form 68R

Recapture of Idaho Broadband Equipment Investment Credit and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 68R | 2023 | |

| 68R | 2022 | |

| 68R | 2021 | |

| 68R | 2020 | |

| 68R | 2019 | |

| 68R | 2018 | |

| 68R | 2017 | |

| 68R | 2016 | |

| 68R | 2015 | |

| 68R | 2014 |

Form 75

Fuels Use Report and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 75 | 2020 | |

| 75 | 2019 | |

| 75 | 2018 |

Form 75-BST

Fuels Tax Refund Worksheet, Idaho Consumers with Single or Multiple Bulk Storage Tanks

| Form ID | Form Name | Year |

|---|---|---|

| 75-BST | 2023 | |

| 75-BST | 2016 |

Form 75-LFA

Fuels Tax Refund Worksheet, Line Flush Allowance

| Form ID | Form Name | Year |

|---|---|---|

| 75-LFA | 2023 | |

| 75-LFA | 2023 | |

| 75-LFA | 2006 |

Form 75-NM

Fuels Tax Refund Worksheet, Nontaxable Miles (Special Fuels Only)

| Form ID | Form Name | Year |

|---|---|---|

| 75-NM | 2023 | |

| 75-NM | 2018 |

Form 75-PTO

Fuels Tax Refund Worksheet - Power Take-off and Auxiliary Engine

| Form ID | Form Name | Year |

|---|---|---|

| 75-PTO | 2023 | |

| 75-PTO | 2023 | |

| 75-PTO | 2021 |

Form 850-U

Self-Assessed Use Tax Return and Instructions

| Form ID | Form Name | Year |

|---|---|---|

| 850-U | 2023 | |

| 850-U | 2019 |

Form 96

Form 96 Annual Information Return

| Form ID | Form Name | Year |

|---|---|---|

| 96 | 2023 |

Form 402

Individual Apportionment for Multistate Businesses

| Form ID | Form Name | Year |

|---|---|---|

| 402 | 2022 | |

| 402 | 2021 | |

| 402 | 2020 | |

| 402 | 2019 |

Form ID-FTHB

Beneficiary and Withdrawal Schedule - First-time Home Buyer Savings Account

| Form ID | Form Name | Year |

|---|---|---|

| ID-FTHB | 2023 | |

| ID-FTHB | 2023 | |

| ID-FTHB | 2022 | |

| ID-FTHB | 2021 | |

| ID-FTHB | 2020 |

Form ID-VP

Income Tax Voucher Payment

| Form ID | Form Name | Year |

|---|---|---|

| ID-VP | 2025 | |

| ID-VP | 2024 | |

| ID-VP | 2023 | |

| ID-VP | 2022 | |

| ID-VP | 2021 | |

| ID-VP | 2020 | |

| ID-VP | 2019 |

Form ST-102

Use Tax Exemption Certificate, New Resident

| Form ID | Form Name | Year |

|---|---|---|

| ST-102 | 2022 |

Form TCR

Sales Tax Refund Claim

| Form ID | Form Name | Year |

|---|---|---|

| TCR | 2023 | |

| TCR | 2009 |

Form 51

Estimated Payment of Individual Income Tax

| Form ID | Form Name | Year |

|---|---|---|

| 51 | Current Version | 2025 |

| 51 | 2024 | |

| 51 | 2023 | |

| 51 | 2022 | |

| 51 | 2021 | |

| 51 | 2020 | |

| 51 | 2019 | |

| 51 | 2018 | |

| 51 | 2017 | |

| 51 | 2016 | |

| 51 | 2015 |