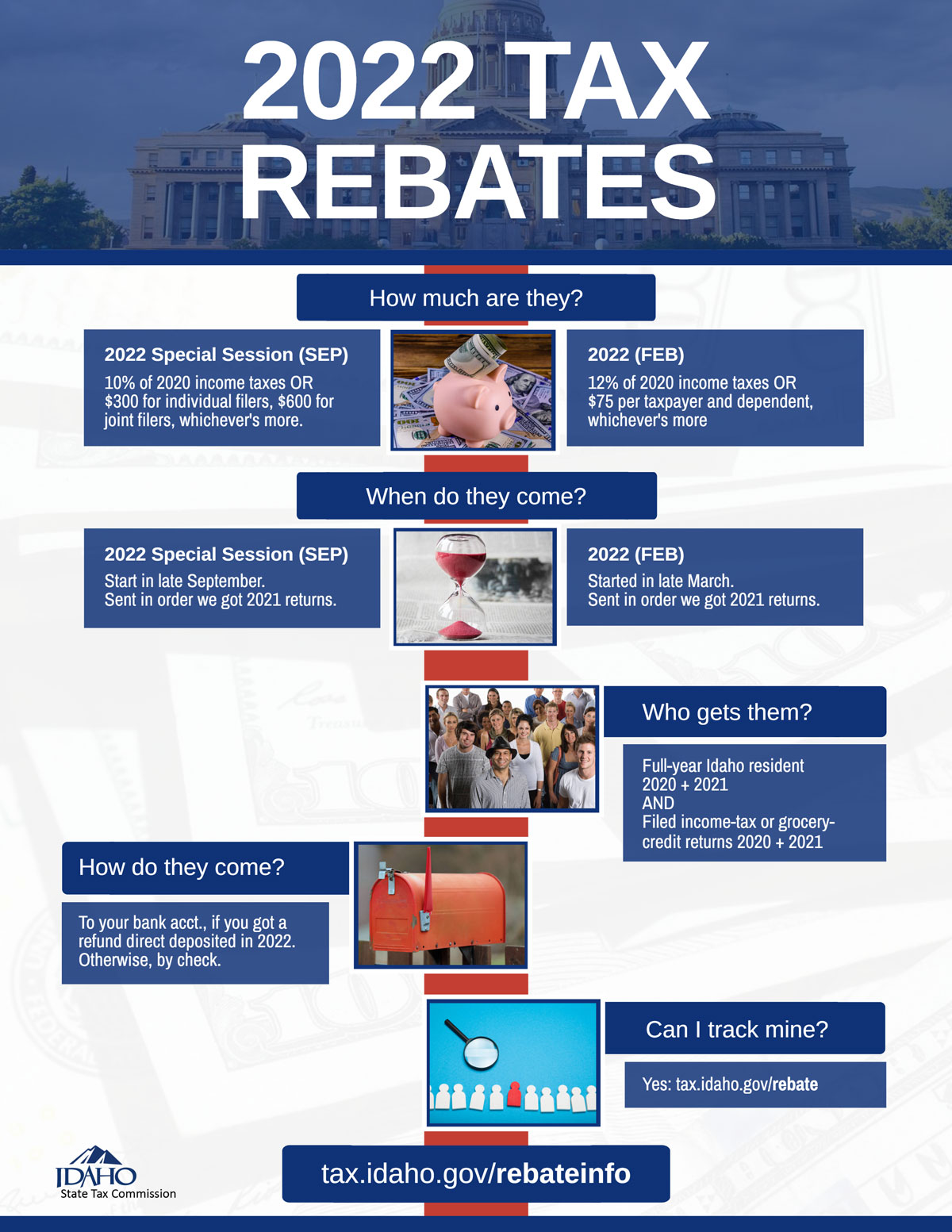

Idaho is giving eligible taxpayers two rebates in 2022:

- 2022 Special Session rebate: On September 1, 2022, a Special Session of the Idaho Legislature passed and Governor Brad Little signed House Bill 1 authorizing a tax rebate to full-year residents of Idaho.

- 2022 rebate: On February 4, 2022, Governor Little signed House Bill 436 that provided a tax rebate to full-year residents of Idaho.

FAQs

The amount of each rebate is different, but the qualifications and process to get them are the same.

What are the amounts of the tax rebates?

The amounts are based on the most recent, approved 2020 tax return information on file at the time we issue the rebates.

- Amount of the 2022 Special Session rebate, whichever is greater:

- $300 for individual filers [includes filing statuses Single, Head of Household, Qualifying Widow(er) and Married Filing Separately]; $600 for joint filers

- 10% of the tax amount reported on Form 40 (line 20), or Form 43 (line 42) for eligible service members using that form

- Amount of the 2022 rebate, whichever is greater:

- $75 per taxpayer and each dependent

- 12% of the tax amount reported on Form 40 (line 20), or Form 43 (line 42) for eligible service members using that form

- Amount of the 2022 Special Session rebate, whichever is greater:

I received an email telling me I’m going to get a rebate. Is this legitimate?

- Yes. We send emails about the rebates on behalf of Governor Little and the Legislature. The emails go to people who e-filed their 2021 income tax returns because we have their email addresses.

Who’s eligible for the tax rebates?

- Any Idahoan who was a full-year resident in 2020 and 2021 and who also filed an Idaho individual income tax return or a Form 24 for those years is eligible for the rebates. Nonresidents and part-year residents aren’t eligible.

- A full-year resident is someone domiciled in Idaho for the entire tax year. Domicile is the place you have your permanent home and where you intend to return whenever you’re away; it’s the place that’s the center of your personal and business life. If you’re stationed in Idaho on active military duty, you’re considered a resident of the state where you’re domiciled.

What do I need to do to get my tax rebates?

You need to file your 2020 and 2021 individual income tax returns by December 31, 2022, to receive the rebates.

How do I receive my rebate payments?

- Taxpayers who provided valid bank information when filing their 2021 tax returns receive the payments through a direct deposit to their bank account. All other taxpayers receive checks at the most recent address we have on file. This includes taxpayers who used a refund product (such as a refund anticipation loan) when filing their return with tax software or a tax preparer.

When will the Tax Commission start issuing the tax rebate payments?

- We start processing payments for the 2022 Special Session rebate in late September, issuing them to eligible taxpayers in the order of the date we received the 2021 tax returns. We start with taxpayers who are eligible to receive the rebate through direct deposit and then move to those who will receive a check. About 75,000 payments will go out weekly. We’ll continue to process payments throughout 2022 and early 2023 as taxpayers file their returns and become eligible for the rebate.

- We’ve already issued the majority of the first 2022 rebate payments, but we continue to send more as taxpayers file their returns and become eligible.

How can I check the status of my rebate payment?

- You can track the status of your rebates using the Where’s My Rebate tool at tax.idaho.gov/rebate

- You can use this tool anytime. The information in the tool is the same information that our Taxpayer Services representatives can provide over the phone.

- To retrieve your rebate status, you’ll need:

- Your Social Security number or Individual Taxpayer Identification Number

- Your Idaho driver’s license number, state-issued ID number, or 2021 Idaho income tax return

What if my filing status changed between 2020 and 2021?

- We calculate the rebates using the information on your 2020 tax return. If your filing status changed when you filed your 2021 tax return, the amount of the rebates you receive might be affected in certain cases. For example:

- You filed as Single in 2020 but filed as Married Filing Jointly in 2021. Your rebates are based on the 2020 return, and you receive the full amount of each rebate.

- You filed as Married Filing Jointly in 2020 but filed as Single or Head of Household in 2021. Your rebates are based on the 2020 return, but you receive only half the amount of each rebate. We split the rebates equally between you and your ex-spouse (following Idaho Community Property law 32-906).

- We calculate the rebates using the information on your 2020 tax return. If your filing status changed when you filed your 2021 tax return, the amount of the rebates you receive might be affected in certain cases. For example:

My address has changed since I filed my 2021 tax return. How do I update it so I can get my rebate check or checks?

- Email RebateAddressUpdate@tax.idaho.gov to request an update. Please provide your:

- Full Name

- Last four digits of your Social Security number or Individual Taxpayer Identification Number

- Previous address

- New address

- We’ll update your address within three to five business days. However, we won’t be able to reply to your email due to the number of requests we expect. Please only use this email address to send us a change to your mailing address. If you have rebate questions, see the other FAQs on this page or email us at Submit a question. You should receive a response within 5 to 7 business days.

- Email RebateAddressUpdate@tax.idaho.gov to request an update. Please provide your:

Can I still get the tax rebates if I wasn’t required to file a tax return?

- If you aren’t required to file a return, you might be eligible to file one for any overpaid withholding or to receive the grocery credit. You must be an Idaho resident to receive the grocery credit. Visit the Income Tax hub at tax.idaho.gov/incomehub for more information.

Why haven’t I received my rebates? I filed my 2020 and 2021 tax returns.

- All income tax returns go through fraud detection reviews and accuracy checks. We might send you letters to verify your identity or to ask for more information. If you don’t respond to these letters, we can’t finish processing your returns. As a result, your rebate payments will be delayed.

Do you apply my tax rebates to other amounts I owe?

- Yes. We’ll reduce your rebate payment if you have other tax debts with the Tax Commission (e.g., you owe income tax, sales tax, withholding tax, etc.), or if you have any outstanding obligations to the following:

- Idaho Department of Health and Welfare (usually for unpaid child support). Call (208) 334-2479 in the Boise area or toll free at (800) 356-9868.

- Idaho Department of Labor (for unreimbursed unemployment overpayments). Call (208) 332-3576 in the Boise area or toll free at (800) 448-2977.

- Idaho Supreme Court (for unpaid court-ordered fines, fees, or restitution). Call (208) 947-7445.

- County Sheriff departments (for sheriff’s garnishments). Call (208) 577-3750.

- Internal Revenue Service (for unpaid federal tax debts). Call toll free at (800) 829-7650.

- Bankruptcy trustees – You might receive a letter from us if we reduce your rebate payment.

- Yes. We’ll reduce your rebate payment if you have other tax debts with the Tax Commission (e.g., you owe income tax, sales tax, withholding tax, etc.), or if you have any outstanding obligations to the following:

Are the rebates taxable?

- Rebates are handled exactly like regular refunds; they’re not taxable to Idaho. However, they might be taxable on the federal level. Please see the instructions for your federal income tax return for reporting state and local income tax refunds.

Who can I contact for more information?

- If you have questions, please call us at (208) 334-7660 in the Boise area or toll free at (800) 972-7660.

2021 Tax Rebate

Need information about the 2021 tax rebate? Read our 2021 tax rebate FAQs.